China Short Sellers: Exposing Fraud or Practicing Fraud?

Kai-Fu Lee

Recently, several "China Short Sellers" have developed a scheme to make themselves rich. First, short a US-listed China stock. Then, write a negative report on that company. After the stock drops, cover the short, and pocket a huge profit. This practice itself is already questionable, but what is despicable is how these short sellers take advantage of the information asymmetry between China and the US, and write reports full of holes and lies, knowing that their American readers have no way of verifying them. This paper dissects one such example, Short Seller Citron Research's report "Qihoo's entry into search puts SOHU in play" (August 24). This paper will show that Citron lacks even the most basic understanding of the Chinese Internet/Search market, yet it fabricates and distorts information to deceive investors. It is not my intention to support or challenge Citron's recommendations, but only to expose Citron's ignorance and deception, and raise the question whether any investor should ever trust them.

Citron lacks basic understanding of search

The most ludicrous part of Citron's report is its faulty analysis of search engines and basic misunderstanding search engine Sogou's strategy and products.

First, some background for those unfamiliar with the Chinese market:

1.Sogou is a company majority owned by Sohu, and produces three products:

1) search, comparable to search.

2)Sogou browser, comparable to IE or Chrome browser.

3)Sogou Pinyin IME (input method editor). An IME is a "soft keyboard" that converts typed roman character input (like "beijing") into Chinese characters (like "北京"). IMEs are installed in Windows/Mac and are general purpose text-entry tools (not just for search).

2.Sogou IME is the leading IME in China, with about 74% penetration.

3.Sogou browser is an emerging browser that has increased its user penetration from 5% in 2010 to over 20% recently.

4.Sogou search has had about 1% market share until Sogou Browser became successful. As Sogou Browser increased its penetration to over 20%, Sogou search also increased its share to 3-4.5%.

5.Browser market share can increase search market share, because many Chinese users have a habit of searching from the browser directly. Only about half of the search queries are entered on a search engine's webpage.

6.Pinyin IME is a software product basically detached from search, and has no direct relationship with search engines. (Note that a few IMEs including Sogou have experimented with a feature to encourage users to search directly from the IME, with disappointing results, as it is not natural.) Empirically, search market share and IME market share can be shown to be virtually uncorrelated.

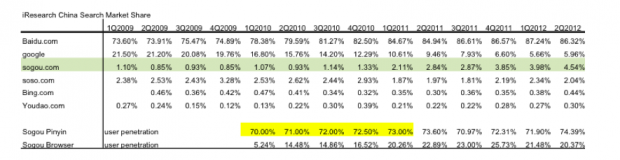

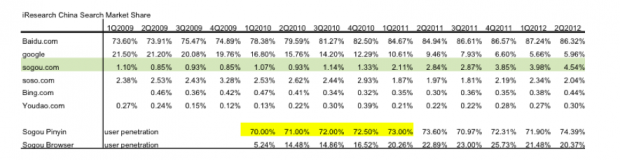

The above points are validated by the following table, showing search market share (from iResearch), as well as Sogou Pinyin and Sogou Browser market penetration (from Sohu):

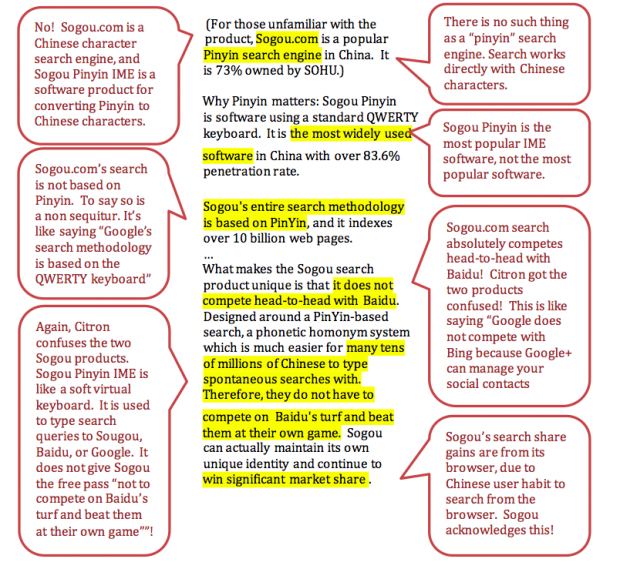

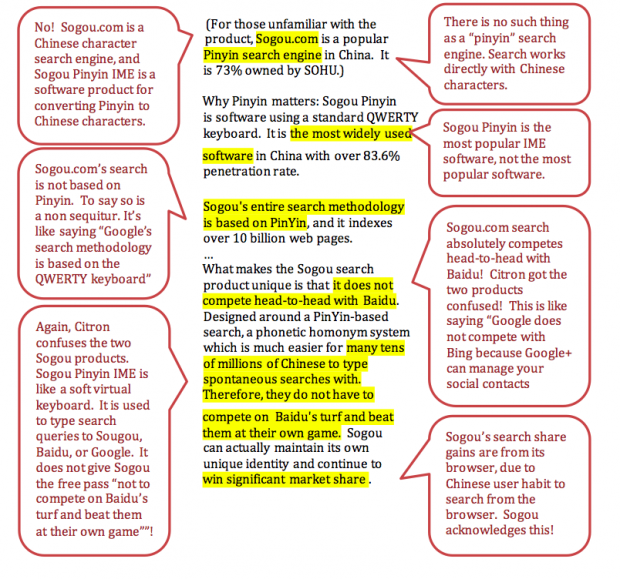

Now, let's analyze the following text, taken verbatim from the Citron report:

The above analysis shows that Citron lacks even basic understanding of "Pinyin", "IME", "search engine", and confuses the two Sogou products. Citron appears to have mentally fabricated a merged product that would not compete with Baidu and "beat [Baidu] at their own game", from which Citron built the primary investment thesis of this report! Also, Citron cannot comprehend the critical role of a browser in China's search market. Chinese users have a habit of entering search queries to a browser, so the success of Sogou's (and Qihoo's) browser has been directly responsible for their search share gains. This fact would further invalidate Citron's conclusion that Sogou is better placed than Qihoo, because Sogou's browser share is significantly lower than Qihoo's. Perhaps that is why they don't acknowledge it.

Citron distorts data and compares apples to oranges

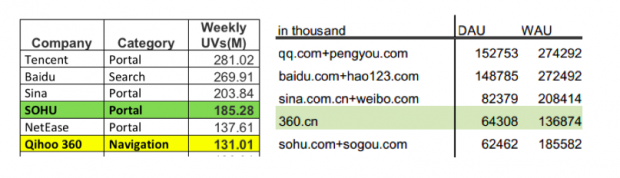

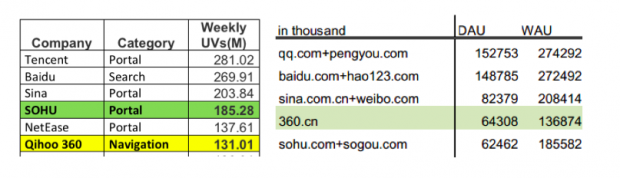

Citron demonstrates Sohu’s superior position by asserting that Sohu has 40% more web traffic than Qihoo, and cites the statistics below (left table below) to illustrate this point.

But this comparison is misleading in three ways:

1.For this comparison, Citron conveniently summed Sohu and Sogou numbers (see right-most column of right chart), even though Sohu is a portal site and only Sogou is comparable to Qihoo.

2.Citron conveniently chose to keep weekly UV (WAU) and removed daily UV (DAU column) from the chart (using DAU would put Qihoo ahead of Sohusogou).

3.While Sogou is similar to Qihoo, Sohu is a portal site and entirely different. What is the purpose of comparing web traffic of two companies in different categories? This is like comparing Yahoo portal to Google search. The value of a click or link on a portal site is dramatically lower than that on a search/navigation site.

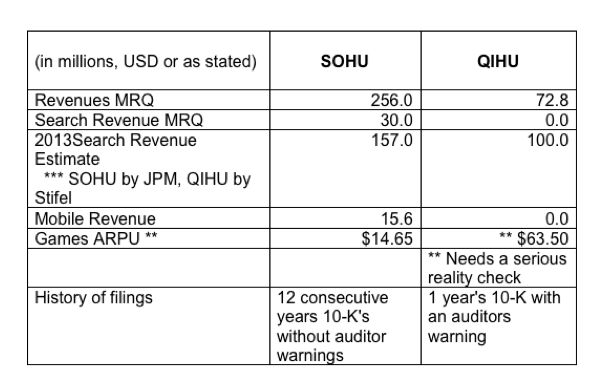

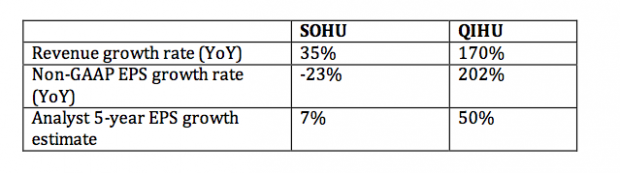

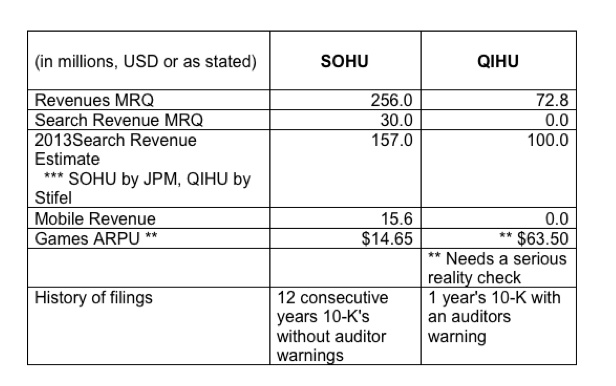

In a second fascinating comparison between Sohu and Qihoo financials, Citron uses the following table to show why Sohu is far superior:

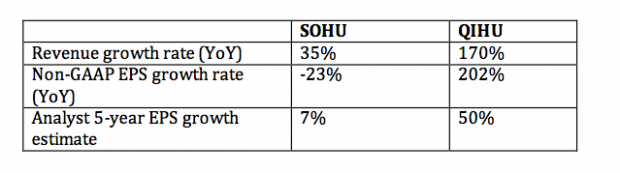

But as any investment novice would question: What about revenue growth and earnings growth for current year and next five years? Growth high-tech stock prices are much more driven by these growth numbers than the numbers Citron chose to cite. Below are the numbers that really matter:

In the two examples above, it is clear that Citron picks "convenient" numbers even if they are of minimal value, and that Citron obscures "inconvenient" numbers, even if they are of critical importance.

Citron does not understand search monetization

In this report, Citron mentions many times that search engines are difficult to monetize using ads, requiring substantial and costly infrastructure that takes years to build. While building a full ad monetization structure is indeed not easy, Citron clearly does not understand the options available to a search engine. The obvious option is to simply use Google's AdWords as a partner site. The search engine site would provide the search results, but the search term would trigger Google AdWords ads (for those advertisers that permit this), with a revenue share that greatly favors the search engine site. Many search engines have worked with Google using this approach, including AOL, , and Tecent's Soso. In some cases, Google also provided search, but in other cases just AdWords. Yahoo is also working this way with Bing. It takes about one quarter to connect a search engine to Google AdWords. This is basic search industry knowledge.

Qihoo has already been Google's partner by sending traffic from to Google, and getting a Google ad revenue share for the traffic referral. As Qihoo launches its own search engine, is it hard to imagine that Qihoo would find a slightly different way to work with its partner Google? Note that these were the same phases Tencent Soso went through with Google: 1) rely on Google for adssearch, 2) launch own search but uses Google ads, 3) launch own ads.

Sogou has chosen not to use Google AdWords, and instead to develop its own ads product and sales team. There were historical reasons for that, but it is naïve to think this is the only approach. In fact, it is an unlikely and irresponsible approach for Qihoo, because this approach explicitly forfeits significant revenue.

Now, how much revenue might come from a Qihoo-Google AdWords partnership? According to JP Morgan report on Tencent, Tencent Soso's monetization from Google AdWords partnership was $13.6M during its last full year working with Google (Q4 2008 to Q3 2009), and Soso's market share for those four quarters was about 2.45%. From 2009 to 2011, the China search query volume has increased about 41%. Let’s assume another 25% increase from 2011 to 2013, for a total of 76% for 4 years. Then, if Qihoo has a 10% search market share in 2013 in a market that is 76% larger than 2009, and uses Google AdWords, Qihoo can deliver search revenue of $98M in 2013 ($13.6M * (10% / 2.45%) * 176%). This is at the top of the range of current analyst estimates of $50 – 100M, and much larger than Citron’s assumption of $0.

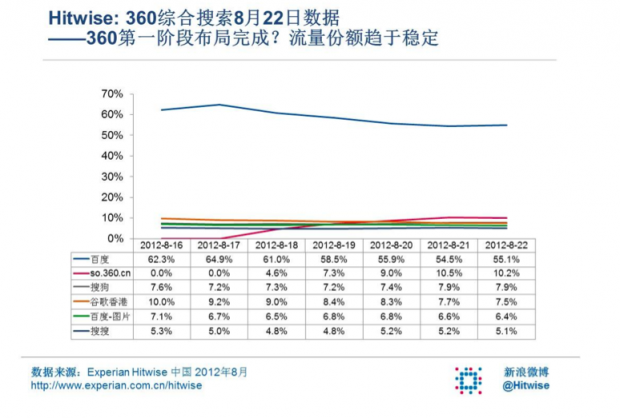

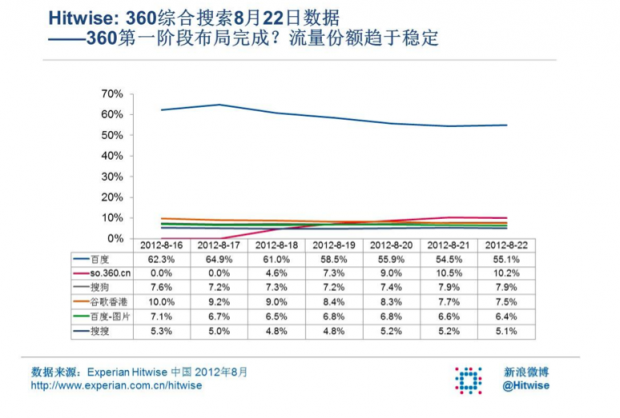

Can Qihoo get a 10% market share? The chart below from Hitwise shows Qihoo already at 10.2% market share as of August 22, 2012:

Citron hand-waves comparisons with misleading analysis

Citron often makes sweeping generalizations and comparisons to justify its recommendation. In this report, Citron made a comparison that Sohu video should have comparable value to Tudou's valuation when Tudou was merged with Youku. However, they ignore many inconvenient but major problems:

1.There are many second-tier video websites comparable to Sohu (LeTV, Qiyi, Sina, Tencent, Xunlei, etc.), especially if one considers metrics ignored by Citron. In a market where one company leads many others by far, the leader will command an even higher premium valuation.

2.The price Youku paid for Tudou includes a sizable premium for creating the single market leader. It cannot be extrapolated to second-tier players.

3.When a market #1 buys #2, #3's value shrinks rather than increases.

4.Youku and Tudou project much higher revenue growth than Sohu video.

Another broad generalization was to take Qihoo's market capitalization gains in four days and simply adding it to Sogou. This is ridiculous, as Qihoo has gained 10% market share in these four days, while Sogou has only maintained its share.

The undisciplined and wild copy-pasting of numbers discredits Citron's analysis.

Conclusion

This paper has shown that Citron is an amateur in the Chinese Internet market, lacking even basic understanding of Chinese text entry (IME), Chinese language (the relationship between Pinyin and Chinese characters), search product features, search monetization, and Chinese user habits (searching in browser).

Citron's primary investment thesis in this report is based on a combined product ( Sogou Pinyin IME) that could bypass Baidu and win share from it. The only problem is that combined product does not exist, and was a figment of Citron's imagination, based on Citron's misunderstanding of the Chinese market.

Citron takes advantage of the fact that most readers of its reports are unfamiliar with the Chinese Internet, and do not read Chinese. This asymmetry emboldens Citron to compare apples and oranges, emphasize irrelevant but convenient data, obscure inconvenient but important data, quote questionable "experts", cite unreadable or irrelevant sources, and wildly copy-paste key financial figures.

Leveraging this information asymmetry and general concerns about Chinese companies, Citron has successfully deceived investors to invest based on Citron's recommendations. Since Citron has already made big bets on these recommendations before their reports are published, Citron doesn't have to be qualified; Citron's recommendation doesn't have to be right; Citron just needs to mislead their readers to follow their recommendations!

So, will you ever trust, follow or read Citron's reports again? Are Citron and other similar China short sellers exposing fraud, or practicing fraud?

Qihoo's entry into search puts SOHU in play

本文首发于雪球网()

下页为中文版,由i美股翻译

Citron等中概做空者——打假还是造谣?

李开复

近期有些机构通过做空中国公司找到了一种快速致富的方法:首先卖空一只中概股票,然后撰写一篇针对这家公司的负面报告,当股价下跌后,补回空头仓位,将把大量利润揣进口袋。这种操作方式在资本市场本身就饱受争议,但是更应被谴责的是,上述做空者是利用中美市场的信息不对称性来获利的,他们撰写的报告漏洞百出,而他们的美国受众却根本没有能力去辨别其中真伪。

Citron(香橼)上周针对搜狐的一份研究报告("Qihoo's entryinto search puts SOHU in play-8-24" )很好地暴露出这些问题:即Citron对于中国互联网和搜索市场缺乏最基本的认识,他们依靠杜撰和扭曲信息去欺骗投资者。我写作这篇文章的目的并不是去支持或者挑战Citron的投资建议,而只是去揭露Citron的无知和欺骗,并且提出这样一个问题:投资者以后是否还应该信任他们?

Citron缺乏对搜索行业的基本常识

Citron报告最荒谬可笑的部分是对搜索业务的错误分析,说明Citron对搜狗的战略和产品以及中国搜索市场缺乏基本的认识。

首先,Citron对中国互联网公司的基本背景认知很匮乏。

1)搜狗由搜狐公司持有多数股权,提供以下三种产品:

(1)搜索——类似于搜索;

(2)搜狗浏览器——类似于IE浏览器或Chrome浏览器;

(3)搜狗拼音输入法——输入法是一种“软键盘”,用户输入罗马字母,可以转换成中文字符。输入法安装在Windows/Mac系统中使用,是通用的文本输入工具(译者注:这些话是针对国外投资者的);

2)搜狗拼音是中国市场份额比较大的输入法,有74%的市场渗透率;

3)搜狗浏览器是一款近年新兴的浏览器,用户渗透率从2010年的5%增加到最近的20%以上;

4)在搜狗浏览器推出前,搜狗搜索引擎有大约1%的市场份额。随着搜狗浏览器的用户渗透率超过20%,搜狗搜索引擎的市场份额也随着增加到3%-4.5%。

浏览器市场份额能够增加搜索市场份额,因为许多中国用户有直接从浏览器搜索的习惯。中国只有大约一半的搜索查询是直接进入到搜索引擎的网页进行操作的。

5)拼音输入法是一种与搜索基本分离的软件产品,与搜索引擎没有直接的关系。(虽然有一些输入法尝试过让用户从输入法可以搜索,而搜狗也尝试过,但是这些实验都很令人失望,因为从输入法搜索对用户很不自然)。最后,根据数据来看,搜索市场份额和输入法市场份额几乎不相关。

以上几点可以通过下面的图表验证,下图展示了搜索市场份额(数据来自艾瑞)和搜狗拼音、搜狗浏览器的市场渗透率(数据来自搜狐):

现在,让我们通过下面的段落逐字逐句地分析Citron的报告:

1)Citron原文:对于那些不熟悉这项产品的人来说,是中国流行的拼音搜索引擎,由搜狐公司持有73%的股份。

点评:错!是中文搜索引擎,搜狗拼音输入法是软件客户端,把拼音输入软件和汉字搜索混淆。

也没有“拼音搜索引擎”这种产品, 搜索的单位是汉字。

2)Citron原文:拼音的重要性:搜狗拼音软件使用标准的QWERTY键盘,是中国使用最广泛的软件,普及率超过83.6%。

点评:搜狗拼音是最常用的输入法软件,而不是最广泛的软件。

3)Citron原文:搜狗引擎的搜索方法是基于拼音,其索引超过10亿个网页。

点评:搜索引擎并不是基于拼音,这么说并不符合逻辑,就像是说,“谷歌搜索方法基于QWERTY键盘”。

4)Citron原文:让搜狗搜索产品与众不同的原因是,他们不与百度进行直接竞争。

点评:搜索绝对在和百度进行直接竞争。Citron混淆了两种产品!这就好比说“谷歌不会和Bing进行竞争,因为Google能够更好地管理你的社交联系。”

5)Citron原文:这种搜索引擎以拼音为基础进行设计,对于数千万中国人来说,这种谐音系统能够让他们更容易地键入拼音进行自发搜索。因此,搜狗不必和百度进行竞争,在对方的领域战胜他们。

点评:又错了,Citron混淆了两种搜狗产品。搜狗拼音是个输入法客户端,是用来打字的。并没有让搜狗绕开和百度的直接竞争并因此赢得搜索市场的胜利。

6)Citron原文:搜狗实际上能够维持自身的特性,持续赢得巨大的市场份额。

点评:搜狗获得的搜索引擎市场份额来自其浏览器,主要是因为中国用户习惯从浏览器进行搜索。这观点来自搜狗!

上述分析表明,Citron对“拼音”、“输入法”、“搜索引擎”缺乏基本了解,混淆了两项搜狗产品。Citron捏造了一个混合产品,认为这个产品既不和百度进行竞争,而又能“在对方的领域战胜他们”,这是Citron该报告里对搜狗搜索业务的主要投资逻辑!

此外,Citron并不理解浏览器在中国搜索市场扮演的关键作用。中国网民习惯直接在浏览器上进行搜索,所以搜狗(和奇虎)在浏览器市场的成功对他们获取搜索市场份额有直接影响。这个事实将进一步驳倒 Citron关于搜狗的处境比奇虎更好的结论,因为搜狗浏览器的市场份额比奇虎浏览器低很多。这或许也是为何Citron不愿意提奇虎和搜狗浏览器的原因。

Citron 故意曲解数据:鸡同鸭比

Citron 出示下面左侧的图表认为搜狐的访问量比奇虎高40%。这个论断是通过三种方法推导出的,下面逐一看看:

1)Citron将搜狐和搜狗的数据合并后再与奇虎比较(见下面右图),而事实上搜狐是一个门户,只有搜狗才与奇虎有接近的业务。

2)Citron故意只使用周UV的数据而去掉日UV,这图上如果使用日UV奇虎会超过搜狐与搜狗之和。

3)只有搜狗才与奇虎有相近的业务,而搜狐是一个门户网站,这样不同类型的业务比较有什么意义呢?就如拿雅虎的门户业务与谷歌的搜索业务去比较。门户网站的链接和点击价值,与搜索引擎和导航网站的有天渊之别。

在另外一张让人迷惑的搜狐与奇虎比较的财报数据图表中,Citron是这样来证明搜狐远远超过奇虎的:

但任何一个投资新手都能看到问题:营收和利润的增速在当前以及未来5年是如何?支撑高科技公司股价的,更多是来自增长数据,而非Citron挑选的那些。下面是这两个公司的增长数据:

上面的两个例子清晰表明,Citron断章取义地节选对自己有利的数据,即使这些数据几乎没有价值;同时隐瞒掉不利数据,但这些又是最重要的。

Citron 不明白搜索货币化是怎么回事

Citron 在报告里多次提及,因为搜索引擎广告的基础设施建设需要持续而昂贵的投入,所以对360搜索的货币化不乐观。确实,建立一套完整的、可货币化的搜索广告系统确实不容易,但 Citron可能不知道其实搜索引擎货币化很简单,只要 Google AdWords 结为合作伙伴就可。搜索引擎站方提供搜索结果,用户输入的搜索词汇则会触发(广告商许可的) Google AdWords 广告,双方分账(搜索引擎获得此间大部分的收入)。很多搜索引擎都采用了这种货币化方法,和谷歌结成了伙伴,包括 AOL 、 以及腾讯的搜搜。有时候,谷歌自己提供搜索;有时候,Google 只提供 AdWords 服务。雅虎和(微软的)必应也是以这种方式展开合作的。将一个搜索引擎接入到 Google AdWords 系统大概需要一个季度的时间。这是搜索行业的基本知识。

奇虎早就是谷歌的合作伙伴了,它把流量从 导向谷歌,以此从谷歌处获得流量引导的收入分成。奇虎推出了自己的搜索引擎后,奇虎继续和它的合作伙伴谷歌合作是很自然地。这个事情很难理解么?请注意看看腾讯的搜搜就和谷歌有这样的一个的合作过程:1)在广告和搜索上均依赖于谷歌;2)推出自己的搜索引擎、广告继续依赖谷歌;3)推出自己的广告系统。

确实,搜狗选择不使用 GoogleAdWords ,转而开发自己的广告产品、建立自己的销售团队。搜狗之所以这么做是有历史原因的,但如果觉得自己开发是唯一的道路就过于天真了。事实上,奇虎应该不会立即选择自己开发的,因为这么做太不明智了——会归零它未来一段时间的搜索广告营收。

那么,这个“奇虎—谷歌 AdWords 联盟”可能为奇虎在2013年带来多少营收呢?根据JP摩根报告,腾讯搜搜与 Google AdWords 的合作的最后一个完整年份(2008年Q4 - 2009年Q3)里,搜搜从中获得了1360万美元的收入,当年,搜搜的市场份额大约为2.45%。从2009年到2011年,中国互联网的搜索量增长了大概41%。我们假设,2011年至2013年搜索量再增长25%、4年增长率为76%;届时(2013年),假如奇虎的搜索份额是10%,而中国搜索市场整体已经变得比2009年大76%,这时候奇虎如果使用了Google AdWords ,便能从中获得9800万美元的营收($13.6M × (10% / 2.45%) × 176%)。这个额度处于当前分析师估计的5000万~1亿美元的区间上限,远远高出Ctiron 预估的零收入。

那么,奇虎可以获得10%的市场份额吗?以下图表来自第三方数据统计机构 Hitwise ,该图表显示截至2012年8月22日,奇虎已经获得了10.2%的市场份额:

Citron用具有误导性的分析进行类比

Citron做了一个搜狐(SOHU)视频和土豆网的比较,结论是搜狐视频的价值和土豆网和优酷合并时的价钱一样。但是,Citron又选择性地忽略了一些特别重要的问题:

1)有很多二线视频网站可以同搜狐对比,包括乐视网,奇艺,新浪,腾讯,迅雷等,特别是当你考虑一些Citron选择忽视的指标时。如果市场上一家公司领先其他家公司很多,那么将获得一定的估值溢价。

2)优酷收购土豆的价格包含为使合并后的公司成为市场主导者而支付的溢价。这不能被视作二线视频公司的估值标准。

3)当市场老大收购老二,老三的估值不但不会提升,反而会降低。

4)优酷和土豆预期的营收增速高于搜狐视频。

另一个一概而论的观点是,将奇虎360(QIHU)四天内的市值增量,简单加在搜狗公司之上。这是荒谬的!在那四天,奇虎的市场份额增加了10%,而搜狗的市场份额仅保持不变。

从这些极不严谨、依靠简单复制粘贴数字堆砌起来的所谓分析来看,Citron的报告缺乏可靠性。

结论:打假还是造谣?

这份报告说明Citron对中国互联网的认知水平仅仅相当于一个门外汉,甚至对输入法(IME)、中文(拼音和汉字之间的关系)、搜索产品功能、搜索引擎货币化和中国互联网用户使用习惯(通过浏览器搜索)等缺乏最基本的认识。

Citron报告结论的基础是:搜狗()和搜狗拼音输入法结合的产品将既能避开百度,又能赢得百度的市场份额。但问题是,根本就没有上述所谓的结合产品,那只是Citron的臆想,是基于他对中国互联网的错误认识产生的。

Citron的报告利用了大多数国外受众对中国互联网的不熟悉,以及无法阅读中文的信息不对称的现象,强调不相关但易得的数据,模糊不易得但是重要的数据,引用令人质疑的“专家”言论以及引用无法验证或不相关的来源,并且简单复制粘贴应该谨慎对待的财务数据。

利用这种信息的不对称,以及最近美国投资人对中概股的担忧,Citron成功地欺骗投资者根据其报告的建议做出投资判断。由于在其报告发布之前,Citron已经建立了大量仓位,因此Citron丝毫不在乎其报告是否合格或者正确。Citron在乎的只是能否诱导投资者听从其投资建议。

所以,你会继续相信Citron的所谓研究报告吗?Citron及其他类似中概做空者,到底是打假的还是造谣的?

本文首发于雪球网()

以上中文版由i美股翻译

0

推荐

京公网安备 11010502034662号

京公网安备 11010502034662号